20. November 2025

Why Companies Must Manage Both Worlds During the Transition Phase

Mandatory e-invoicing in Germany from 2025 marks a significant shift in how businesses handle invoices. But the transition will not be as abrupt as many expect. While legislators are pushing structured formats such as XRechnung or hybrid standards like ZUGFeRD, traditional PDF invoices will remain part of daily business for years.

This creates a challenging but highly strategic phase. Companies that can navigate both worlds, the new structured invoice formats and the old PDF workflows, gain efficiency, compliance, and a competitive edge.

Why PDF Invoices Won’t Disappear Despite the E-Invoicing Mandate

As of 1 January 2025, all companies in Germany must be able to receive e-invoices. These e-invoices are not PDFs but structured electronic documents based on the EN 16931 standard.

Yet PDF invoices will stay relevant for several reasons:

- Many suppliers, especially SMEs and international business partners, will not switch to structured invoices overnight.

- PDFs and paper invoices may still be accepted if the recipient agrees.

- And because EU-wide harmonisation is scheduled for 2030, internationally operating companies will continue to work with mixed invoice landscapes for years.

In short: e-invoicing is coming, but PDFs are not disappearing. Companies focusing solely on XML formats risk process gaps and unnecessary manual work.

What Exactly Is an E-Invoice? (EN 16931, XRechnung, ZUGFeRD Explained)

An e-invoice is not a “digital document” in the PDF sense. It is a structured data format that software can read, validate, and process automatically. EN 16931 defines which fields must be included and how they must be structured to ensure legal compliance.

The Big Challenge: Managing Two Worlds in Parallel

Between 2025 and 2028, companies will operate in a dual system: the old PDF-based workflow and the new XML-based e-invoice landscape. This creates operational complexity.

PDF invoices are unstructured and require OCR and AI extraction, which can be error-prone depending on scan quality. Structured XML invoices deliver clean data but require EN 16931 validation and technical adjustments within ERP or finance systems.

This duality leads to clear risks:

- process discontinuities

- parallel workflows

- higher error rates

- additional IT complexity

- uncertainty regarding compliance and archiving

Without careful design and smart automation, companies risk friction across their entire invoice workflow.

How AI Makes the Transition Phase Manageable

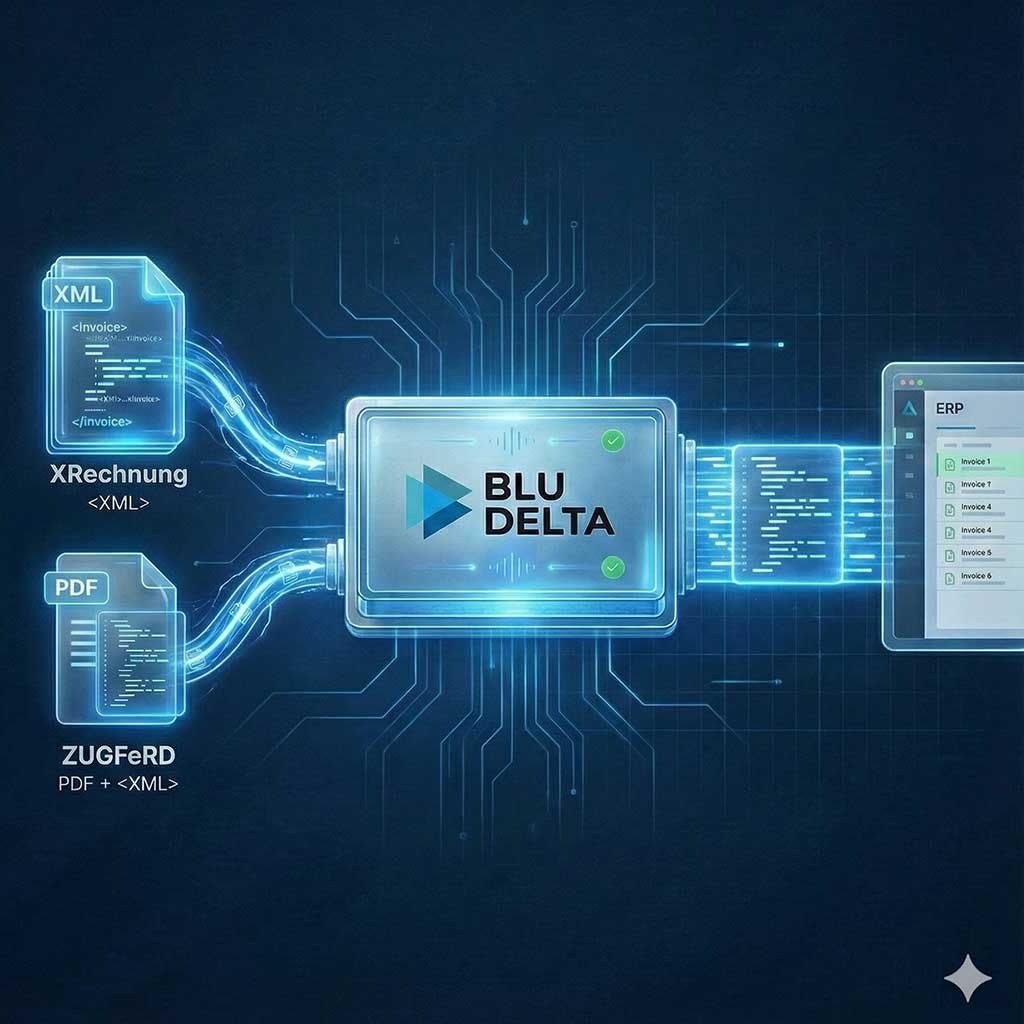

The good news: modern AI systems such as BLU DELTA can process both PDFs and structured e-invoices in a unified workflow.

BLU DELTA extracts fields from PDFs—invoice numbers, totals, VAT, payment data—automatically and reliably. At the same time, structured XML invoices can be validated programmatically: Are totals correct? Are fields complete? Does the invoice comply with EN 16931?

AI bridges the gap between formats by recognising patterns, validating content, and outputting clean, unified data structures into the ERP. This eliminates the need for dual workflows and creates a consistent process throughout.

Why BLU DELTA Perfectly Covers Both Worlds

BLU DELTA was designed for this exact scenario. The platform handles both PDFs and XML invoices seamlessly: fast, compliant, ISO 27001-certified, and fully automated.

In practice, this means:

- PDFs are converted into structured data using AI.

- XML invoices such as XRechnung or ZUGFeRD are validated instantly.

- Errors, inconsistencies, and missing mandatory fields are flagged automatically.

- Clean data is transferred directly to ERP or accounting systems via REST APIs.

BLU DELTA forms the bridge between today’s reality and tomorrow’s requirements. Companies avoid maintaining two separate workflows and instead benefit from a unified, scalable process.

Conclusion: The Transition Phase Is Not a Barrier – It Is an Opportunity

The coming years will be a mix of PDFs and e-invoices. Companies that actively manage this transition, rather than simply endure it, secure a clear advantage.

Those who automate now benefit from:

- less manual effort

- higher data quality

- fewer errors

- legally compliant workflows across all phases

- future readiness for ViDA 2030

The real transformation does not begin in 2027. It has already begun. Companies that master both formats today are building the foundation for truly digital invoice processing tomorrow.

Next Steps: Create Clarity and Make Your Processes Future-Ready

Companies that prepare early avoid risks and establish a stable foundation for efficient and compliant invoice processes. If you want to assess how well your organisation is positioned for e-invoicing and where automation can support you, we are here to help.

BLU DELTA is a product for the automated capture of financial documents. Partners, but also finance departments, accounts payable accountants and tax advisors of our customers can use BLU DELTA to immediately relieve their employees of the time-consuming and mostly manual capture of documents by using BLU DELTA AI and Cloud.

BLU DELTA is an artificial intelligence from Blumatix Intelligence GmbH.

Author:Martin Loiperdinger is Co-Founder and CEO of Blumatix Intelligence GmbH. Previously, he was responsible for the development of copy protection solutions at an internationally operating corporation and later worked as an independent consultant for medium-sized companies and large enterprises. Since 2016, he has been driving AI-supported document processing, making Blumatix one of the most innovative providers in the DACH region. His goal is to enable seamless information exchange between companies.

Contact: m.loiperdinger@blumatix.at